People and businesses guilty of PPP Loan fraud under the Payroll Protection Program (PPP) can be punished differently.

These punishments can be civil or criminal, ranging from fines to being locked up for a long time.

The federal government has been looking for Payroll Protection Program (PPP) loan fraud at businesses all over the country. Many people and companies may have taken advantage of the program’s quick rollout during the COVID-19 crisis to commit fraud. According to a report by the federal Pandemic Response Accountability Committee (PRAC), flaws in the P.P.P.’s structure, administration, and terms made fraud easy.

The PRAC says

“Increased S.B.A. collateral lowers the risk for lenders. As a result, lenders may need to do their due diligence when making loans, which increases the chance that the S.B.A. could lose money. Also, the S.B.A. may need help to spot red flags in loan applications because the number and size of loans are increasing, and loan processing times are getting shorter. Without enough controls, S.B.A. programmes are more likely to be hacked and waste money because they and its lender partners speed up loan transactions to help people quickly.”

With more than $500 million in forgivable loans from the government to more than 4.5 million businesses, the P.P.P. has a vast scope that makes it hard to carry out. But this doesn’t stop the U.S. Department of Justice (D.O.J.), the Office of Inspector General for the Small Business Administration (SBA-OIG), the Internal Revenue Service (I.R.S.), and other federal agencies from doing their jobs. The D.O.J. has already filed charges in many PPP loan fraud cases. People and businesses that committed PPP loan fraud are already being looked for and prosecuted.

Even though the Help, Relief, and Economic Security (CARES) Act, which created the Check Protection Program, doesn’t have any criminal provisions for PPP loan fraud.

Fraud under the programme can lead to civil and criminal charges under many other federal laws. Federal investigations into PPP loan fraud could lead to charges like (but are not limited to).

-

18 U.S.C. 1014 makes it illegal to lie to the Small Business Administration (S.B.A.).

Under 18 U.S.C. 1014, it is against the law to lie to the Small Business Administration (S.B.A.). The law says that anyone who “knowingly makes any false statement or report… to affect in any way the action of the Small Business Administration” will be punished. This language is broad enough to include statements made on business P.P.P. loan applications (including borrower application forms) and business certifications for loan forgiveness.

-

18 U.S.C. 1014 makes it illegal to lie to a bank insured by the FDIC.

18 U.S.C. 1014 also says that giving false statements or reports to banks insured by the Federal Deposit Insurance Corporation (FDIC) or other banks is unlawful. So, businesses and people can be prosecuted if they give the S.B.A. false information, and they can also be prosecuted if they give their A.P.A. lenders false information.

-

Bank Fraud (18 U.S.C. § 1344).

Under 18 U.S.C. 1344, businesses and people can be prosecuted for bank fraud and for making false statements or reports to their A.P.A. lenders. This federal law says that it is illegal to “knowingly execute or try to execute a scheme or artifice (1) to defraud a financial institution or (2) to obtain money, funds, credit, assets, securities, or other property owned, held, or controlled by a financial institution using false or fraudulent pretences, representations, or promises.”

-

Wire Fraud (18 U.S.C. § 1343)

The federal wire fraud law, 18 U.S.C. 1343, is a handy tool for federal prosecutors because it lets them go after significant fines in various situations. The law forbids using the Internet in “any scheme or artifice to defraud, or… obtain money or property using false or fraudulent pretences, representations, or promises…” The U.S. Department of Justice (D.O.J.) has already brought wire fraud charges in several cases involving the A.P.A.

The Penalties continue…

-

(18 U.S.C. 1028A) This is a serious case of identity theft.

18 U.S.C. 1028A says that the federal crime of aggravated identity theft is “knowingly transferring, possessing, or using, without legal authority, a means of identification of another person.” This is done in connection with certain felonies. Some of these crimes are bank fraud and wire fraud. In many cases of APP loan fraud, the Department of Justice has already filed aggravated identity theft charges because it is said that the people involved tried to get loans in the names of companies they did not own.

-

(26 U.S.C. 7201) Tax evasion.

Under 26 U.S.C. 7201, criminal charges can be brought against “any person who willfully tries to evade or avoid in any way any tax imposed by [the Internal Revenue Code].” Many people and businesses accused of PPP loan fraud will also be charged with not paying their taxes. This includes not paying payroll taxes by illegally taking deductions for payroll costs paid for with A.P.A. loan money and not paying income taxes by not reporting income from business activities paid for with A.P.A. loans.

And yet more…

-

18 U.S.C. 1001 says it is a crime to lie to federal agents.

In addition to being prosecuted for making false statements on P.P.P. loan applications and forgiveness certifications, business owners, executives, and others may also be charged for making false statements to federal agents during a P.P.P. loan fraud audit or investigation. Under 18 U.S.C. 1001.

- The Department of Justice can go after anyone who “(1) falsifies, conceals, or covers up by any trick, scheme, or device a material fact; (2) makes any materially false, fictitious, or fraudulent statement or representation; or (3) makes or uses any false writing or document knowing that it contains any materially false, fictitious, or fraudulent statement or entry” during a federal investigation.

-

18 U.S.C. 371 and 18 U.S.C. 1349 talk about conspiracy.

The federal conspiracy laws, 18 U.S.C. 371 and 18 U.S.C. 1349, make it possible to go after multiple people and companies that work together to try to get federal money through fraud under the P.P.P. Importantly; these efforts don’t have to lead to a P.P.P. loan being made for a criminal conspiracy charge to be made.

-

Attempt (18 U.S.C. § 1349).

The federal attempt law also makes it illegal to try to commit P.P.P. loan fraud, even if you fail. 18 U.S.C. 1349 says, “Any person who attempts…to commit any offence under this chapter shall be subject to the same penalties prescribed for the offence that was the subject of the attempt…”

-

Breach of the False Claims Act (31 U.S.C. §§ 3729 – 3733)

The federal False Claims Act punishes fraud against federal government programmes with civil and criminal penalties. In cases of unintentional P.P.P. loan application or forgiveness certification fraud, the Department of Justice may bring civil charges. The Department of Justice may bring criminal charges in intentional PPP loan fraud cases.

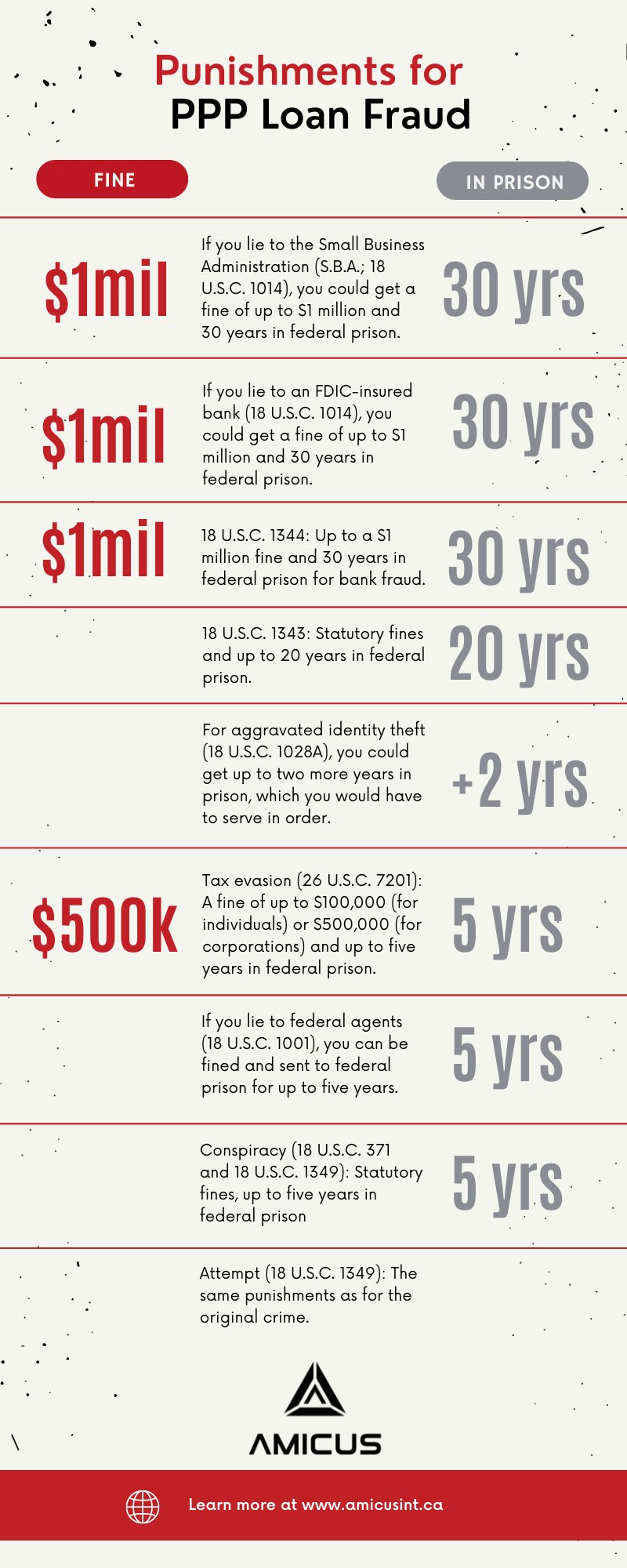

Possible Punishments for Federal PPP Loan Fraud

How bad is an investigation into PPP loan fraud?

Here are the punishments for each of the above crimes:

- If you lie to the Small Business Administration (S.B.A.; 18 U.S.C. 1014), you could get a fine of up to $1 million and 30 years in federal prison.

- If you lie to an FDIC-insured bank (18 U.S.C. 1014), you could get a fine of up to $1 million and 30 years in federal prison.

- 18 U.S.C. 1344: Up to a $1 million fine and 30 years in federal prison for bank fraud.

- 18 U.S.C. 1343: Statutory fines and up to 20 years in federal prison.

- For aggravated identity theft (18 U.S.C. 1028A), you could get up to two more years in prison, which you would have to serve in order.

- Tax evasion (26 U.S.C. 7201): A fine of up to $100,000 (for individuals) or $500,000 (for corporations) and up to five years in federal prison.

- If you lie to federal agents (18 U.S.C. 1001), you can be fined and sent to federal prison for up to five years.

- Conspiracy (18 U.S.C. 371 and 18 U.S.C. 1349): Statutory fines, up to five years in federal prison under 18 U.S.C. 371, and the same penalties as for the underlying crime under 18 U.S.C. 1349.

- Attempt (18 U.S.C. 1349): The same punishments as for the original crime.

Infractions of the False Claims Act (31 U.S.C. 3729–3733) can lead to fines and up to five years in federal prison in civil cases and fines and up to five years in federal prison in criminal cases.

Amicus International Consulting can help, contact us for a free consultation.