The PPP Loan program was plagued by fraud.

Now a lender could face a reckoning as the scandal becomes more complex.

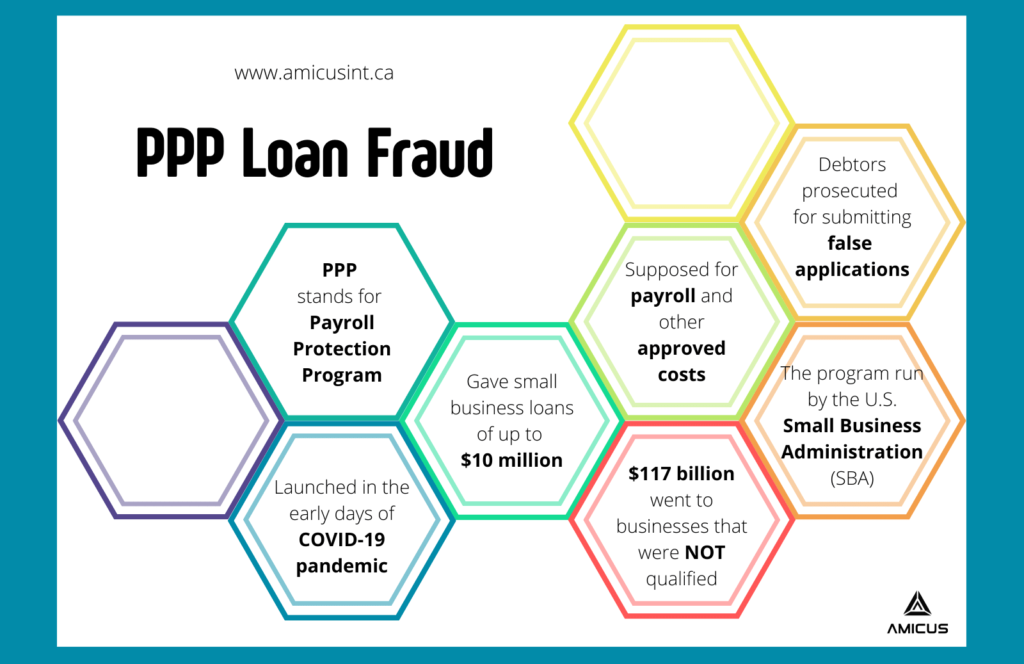

In the early days of the COVID-19 pandemic, the Payroll Protection Program (PPP) was a major federal economic aid programme. It gave small businesses loans of up to $10 million that could be forgiven if they were used for payroll and other approved costs.

But fraud has been a problem with the programme since it started in the spring of 2020. Banks and other private lenders were in charge of processing applications. Recent estimates show that more than $117 billion of the $780 billion in federal loans went to businesses that didn’t qualify.

Hundreds of debtors have been prosecuted for submitting false applications to the PPP. Still, few lenders have been held accountable for their part in approving these fake loans.

PPP fraud case in South Florida

A strange filing in one of the many PPP fraud cases in South Florida showed that one of the biggest lenders in the program’s first year might soon face the consequences.

In a Florida case, Kabbage said federal prosecutors are looking into its PPP lending practices in Massachusetts and the Eastern District of Texas. The filing says that the Civil Division of the U.S. Department of Justice (DOJ) coordinates these investigations. When asked for comments, neither the district nor the DOJ replied.

Ben Curtis, a partner in the Miami office of McDermott Will & Emery and former deputy chief of the DOJ Criminal Division’s Fraud Section, said, “It’s not a good sign when two prosecutors’ offices independently come to the same conclusions based on evidence they got from different sources.” Curtis said that the fact that the investigation was made public was strange since civil investigations are usually kept secret. He said, “If I were a client, I’d never want that to be known to the public.”

The filing came as Kabbage tried to get out of being called to testify by federal prosecutors in the Southern District of Florida. Next month, a PPP Loan fraud case will be heard in a Fort Lauderdale court.

Kabbage is not a target in this case.

Still, he said that his testimony in the case could be used against him in other federal investigations, which he called “financially… an existential threat to Kabbage.” But U.S. District Judge William P. Dimitrouleas did not buy Kabbage’s argument. He denied Kabbage’s request, which means that the online lender could be called to testify in the criminal trial of Luke Joselin, which is set to start on August 15.

Kabbage is also one of several financial technology companies being looked into by the House Select Oversight Subcommittee on the Coronavirus Crisis for their role in the PPP fraud.

The PPP programme saved the Georgia-based online lender from laying off workers in March 2020 to being a desirable takeover target in just a few months. This was partly because the company said it processed $7 billion in PPP loans that year.

PPP Lenders

The lender, heavily backed by the Japanese investment firm SoftBank, made hundreds of millions of dollars in fees from the $7 billion in loans. This helped draw the attention of American Express, which reportedly bought the company in October 2020 for $850 million.

But the company’s speed—it used algorithms instead of people to approve loans—has made people wonder how it checked out loan applicants.

When American Express bought Kabbage, it did not take over its loan portfolio, which included a PPP loan fraud. Instead, it put them in a holding company called KServiceicing. The big credit card company has tried to distance itself from Kabbage’s performance in the PPP programme, but these multiple investigations might make it impossible for them to avoid hard questions.

Jim Richards, a former prosecutor and senior financial risk officer at Wells Fargo and Bank of America, asked, “What did AMEX know, if anything, and when?”

The CEO of KServicing, Laquisha Milner, didn’t respond to multiple requests for a statement, and messages left on the company’s media line were not returned.

American Express also answered only once for statements. Before, the company said American Express and KServicing were two different companies.

“Fraudulent”

As part of the CARES Act, passed in March 2020, the COVID-19 small business assistance programme was created. It was up to lenders to check out and approve programme applicants. The federal government would pay back the lenders in the end.

The program, run by the U.S. Small Business Administration (SBA), saved many businesses in the early months of the COVID-19 pandemic that were forced to close and didn’t know what would happen next. However, it was also full of fraud. The SBA Office of Inspector General thought PPP fraud loans worth $4.6 billion were given out in the programme’s first year.

Researchers at the University of Texas at Austin found that fraud in the programme cost just over $64 billion by one measure and more than $117 billion by other estimates. In some counties, the number of industry beneficiaries was higher than the number of businesses in those counties. The paper’s authors say that both $64 billion and $117 billion are low estimates.

The Herald said that Kabbage approved a large number of questionable PPP loans. The federal government would repay the loan in the end, and the programme’s rules let lenders trust the debtors’ word on whether their businesses were eligible. In the past, Herald articles found approved companies even though they didn’t follow the program’s rules. For example, the authorities said that businesses had to have been open since at least February 15, 2020 and that business owners who were facing felony charges or had just been convicted of financial fraud couldn’t apply.

Even though it was already known that the DOJ was looking into Kabbage and other financial technology (FinTech) companies. The Florida filing gives much more information about how the online lender is being looked into.

Kabbage said that the U.S. Attorney’s Office in Massachusetts has been looking into it for more than a year under the False Claims Act, which prevents government fraud. “Under the theory that Kabbage improperly approved PPP loans that were fraudulent or not within the parameters of the Small Business Administration (‘SBA’).” The company also said that “the adequacy of Kabbage’s fraud and anti-money laundering controls over the same period” is being looked into by the U.S. Attorney’s Office in East Texas. Kabbage said that the DOJ’s civil division is handling both investigations. When asked for statements, the U.S. attorneys’ offices in Massachusetts and the Eastern District of Texas did not answer.

Richards said that the Texas investigation is vital because the PPP programme required lenders, even ones like Kabbage that were not banks, to set up vital programmes to stop money laundering and check up on customers.

“That’s probably where Kabbage gets the most attention,” he said. Richards, who now runs a financial risk consultancy called Regtech Consulting, has kept track of PPP fraud cases and found that Kabbage has been linked to nearly one in five federal PPP fraud prosecutions.

Banks were paid fees on a sliding scale based on the loan size. This allowed Kabbage to make hundreds of millions of dollars in payments from loans it approved directly and through Cross River Bank and Customers Bank, which were its partner banks. Kabbage recently sued Customers Bank, saying that the Pennsylvania-based bank owed Kabbage “tens of millions” in PPP fees that the bank and Kabbage had agreed to split. Customers Bank didn’t say anything, saying that a lawsuit was coming concerning the PPP Loan Fraud cases.

Unforgiven loans

Kabbage’s PPP performance isn’t just bad because of the chance of fraud.

It is hard for many small business owners who got PPP loans through Kabbage to get their debts forgiven. According to the programme’s rules, the loans would be forgiven if they were used to pay wages and other approved costs, even though most of the loans approved in the first year of the programme have already been forgiven. Kabbage, now called KServicing after merging with American Express, had the lowest forgiveness rate among the major lenders in the programme’s first year.

Several debtors have filed a class action lawsuit against it. They say that KServicing’s process for forgiving loans has been a “total and continuing failure.” They call the company “one of the most opportunistic profiteers to come out of the global COVID-19 pandemic.” servicing said that the lawsuit should be thrown out because the loans were given through the CARES Act, which, it said, “does not provide for a private right of action” that lets private parties sue.

Kabbage used to brag about how successful it was at giving PPP loans to small businesses and businesses owned by women and minorities. Businesses which have had trouble in the past getting loans from traditional banks. Because of this, it is now more challenging for those same businesses to get their PPP loans forgiven.

Contact Amicus International today for more information.